Inheritance Tax or IHT as it is better known, is a tax paid on your estate. This includes property, money (including investments and cash in the bank), possessions and also life insurance policies if they are not put into trust.

When you die, the Government assesses how much your estate is worth, then it deducts your debts from this to give the value of your estate. It is your beneficiaries who will be hit with the tax bill.

There’s normally no Inheritance Tax to pay if the total value of your estate is below the £325,000 threshold or you leave everything to your spouse or civil partner, or charity.

If you’re married or in a civil partnership and your estate is worth less than your threshold, any unused threshold can be added to your partner’s threshold when you die.

The standard Inheritance Tax rate is 40%. It’s only charged on the part of your estate that’s above the threshold.

One of the best ways to avoid paying any tax is to reduce your estate value to below the £325,000 threshold. However despite perhaps wanting to splurge in retirement many want to ensure that their loved ones are looked after in the event of death and so this is not a feasible option

It is important to remember that as of April 2015 pension pots are no longer be subject to a 55% death tax when passed on. This means that any funds in a pension pot can be passed on to a named individual without any tax implications if they die before the age of 75. You may want to consider transferring all of your non-pension assets to fund your pension to bring the funds outside of the IHT arena.

There’s also no Inheritance Tax to pay on gifts between spouses or civil partners. You can give them as much as you like during your lifetime, however other gifts count towards the value of your estate. People you give gifts to will be charged Inheritance Tax if you give away more than £325,000 in the 7 years before your death.

Importantly you can give away £3,000 worth of gifts each tax year (6 April to 5 April) without them being added to the value of your estate. This is known as your ‘annual exemption’.

You can carry any unused annual exemption forward to the next year – but only for one year.

If you have a life insurance policy make sure you place this into trust. This way it does not form part of your estate for inheritance tax. In the event of your death and whilst the policy is in force, the sum assured will be paid to the trust, as opposed directly to the beneficiary. Another benefit of a trust is that the benefits can be paid as soon as the insurer admits the claim rather than waiting for Probate.

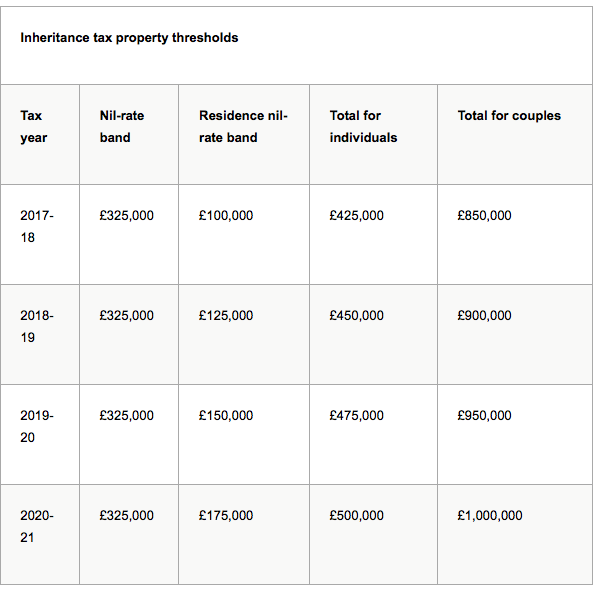

Probabaly the biggest shake up to occur in relation to IHT came when Former Chancellor of the Exchequer George Osborne revealed in 2015 that he would scrap duty when parents or grandparents pass on a home worth up to £1 million (£500,000 for singles). This is being phased in gradually until April 2020.

From April 2017, the amount you can pass on to your loved ones without having to pay any inheritance tax had a significant boost. And as the new rule is slowly phased in by 2020 married couples and civil partners will be able to pass on as much as £1 million without their heirs being hit by a big tax bill.

This means that, individually, you’ll be able to pass on an extra £175,000 free of inheritance tax . But crucially, you’ll only get this extra tax-free allowance if what you’re passing on – your estate – includes your home. Furthermore the government’s rules state that only ‘direct descendants’ of people who have died can benefit from the new main residence nil-rate band.

The table below shows how your inheritance tax allowance will increase over the next few years.

Each year, the new allowance will rise by £25,000 until April 2020, when you’ll be able to pass on an additional £175,000. As married couples and civil partner’s can inherit any unused allowance from their spouse, a total of £1 million can be passed on tax free. And after 2020, the plan is for the main residence nil-rate band to increase annually with inflation.

Tax is never far from the minds of most expats, making it an essential part of money management. It is vital that you understand the tax you or your loved ones are likely to be subject to. Unfortunately there is no way to completely avoid Inheritance Tax unless you do fall below the nil rate- band but as you can see there are some ways to help mitigate it.

To speak to me about your personal set of circumstances please contact me directly, either by email or please click on the ‘chat with me now’ tab below.

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: April 19, 2023|2.5 min read|

How Does a Financial Adviser Add Value?

Financial advisers can be valuable resources for individuals seeking to manage their money and achieve their financial goals. While many people believe that financial advisers simply provide investment advice, they actually offer a range of services that can help their clients achieve financial success. In this blog, we’ll explore how financial advisers add value and the benefits they can offer.

Read more