Interest rates and Cash Equivalent Transfer Values (CETV’s) are indirectly linked, meaning that any change in rates can have a knock-on effect that may eventually mean an adjustment in your CETV.

If you are considering a pension transfer and are wondering how recent economic changes may impact the cash equivalent transfer value of your final salary pension, read on!

How Are CETVs Calculated?

In order to understand the relationship between interest rates and CETVs, we need to first look at how the value is calculated.

Your CETV is the lump sum that you will receive, should you decide to give up the benefits in your Defined Benefit scheme and transfer out the CETV to a new Defined Contribution scheme. It is calculated according to the perceived value of the benefits you will be giving up.

In order to calculate this, a number of assumptions will have to be made. Pension scheme administrators will look at many factors, including your current age, the age you are likely to retire and your probable cost of living. They will consider your life expectancy and any investments already made into the scheme, as well as any costs you may have incurred.

By looking at these factors, administrators can estimate how much it is likely to cost to fulfil annual pension requirements from the schemes normal retirement date. This figure is then discounted back to today’s date to provide a current CETV.

Why Are CETVs So High at the Moment?

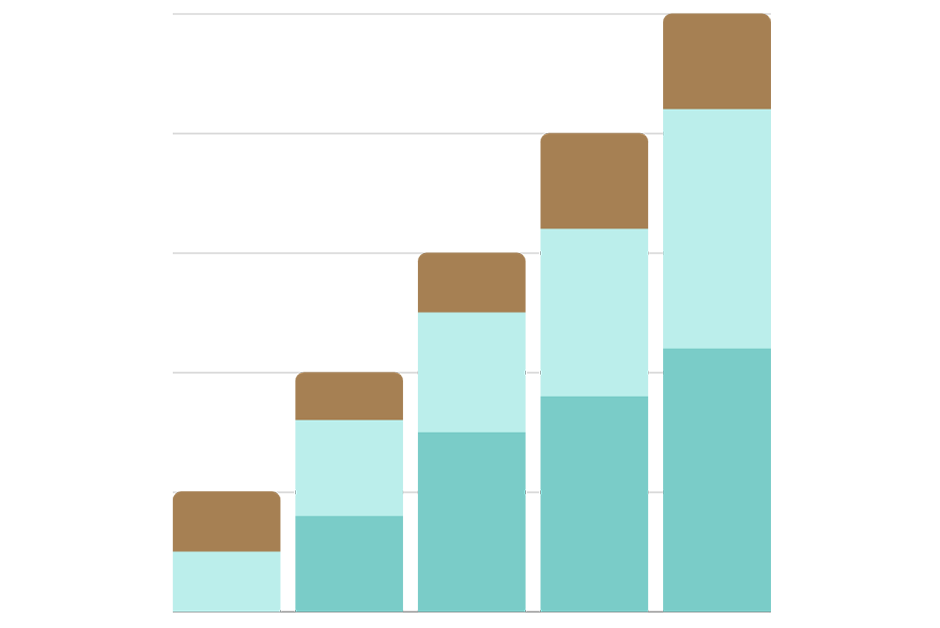

CETV values have been rising steadily since 2016 and many financial experts have put this trend down to falling interest rates.

Final Salary Pension Transfer values are closely linked to the value of Gilt Yields. As gilt yields go down, transfer values go up. Gilt Yields, linked to interest rates, have been at an all-time low, so many people have seen their transfer values soar.

Why are Gilt Yields Important to Pension Transfer Values?

Gilts are British Government Bonds issued by HM Treasury. They pay a fixed amount of interest over a set period of time. The yield is the interest rate on a gilt based on its buying price, so when the value of the Gilts goes up, the yield goes down.

Gilt values tend to be high when interest rates are low because the rate of interest they pay will often beat anything you would get in a savings account and will, therefore be in high demand. Similarly, the opposite is true – if interest rates rise, Gilt values can drop.

Are CETVs Likely to Reduce as Interest Rates Rise?

Interest rates are not the only factor in determining gilt values. The rate of inflation (currently at the highest level in almost 50 years) also plays its part. In February 2022, the Bank of England raised interest rates from 0.25% to 0.5%. This was done in response to the rapid rise in the rate of inflation after three years of rates holding steady.

If you are concerned about the CETV value of your defined benefit pension, or you have been thinking of transferring your pension for a while, then it is a good idea to speak to a Pensions Specialist. Do not attempt to try to ‘time the market’. Your CETV could rise, or it could fall. Timing the market is impossible. Any decision should be based on whether your current CETV allows you to meet your goals.

Cash Equivalent Transfer Values are usually valid for 3 months, which fixes the value of your transfer, offering you some buffer against the volatility of changeable values.

But there are many things to consider, and this is never a decision that should be made solely on the state of the market. If you would like to understand more book a discovery call with me today.

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: July 10, 2024|3.2 min read|

The Merits of Accessing Your Pension Commencement Lump Sum in Stages

As you approach retirement, one of the significant decisions you'll face is how to access your pension commencement lump sum (PCLS). While it might be tempting to take the entire amount in one go, there are several benefits to accessing your PCLS in stages.

Read more

- Published On: May 26, 2023|4.7 min read|

Navigating UAE Succession Law: A Guide for Expats

The United Arab Emirates (UAE) has become a popular destination for expatriates seeking new opportunities and a vibrant lifestyle. However, when it comes to matters of succession and inheritance, ex-pats residing in the UAE need to be aware of the unique legal framework in place.

Read more