If you have had several jobs over the years or moved house many times, you may have misplaced some of your pension pots.

According to recent figures, there are approximately 1.5million pensions that remain unclaimed in the UK.

These pots are worth a total of £19billion, which works out to roughly £13,000 per pension.

If you think there is a chance one of them might be yours, now is a great time to check!

Could you be missing out?

To find out, you’ll need to check through all your old pension paperwork. Look out for employment contracts, payslips, annual pension statements or starter packs. Any of these might provide you with details of your pension administrator. Pension administrators often change but this will be a good starting point.

If you have misplaced this paperwork, you could try contacting past employers. They will most likely need to know the dates you worked for them so they can tell you who their pension provider was at the time. If any company details have changed, you should still be able to track them down via the Companies House website.

Alternatively, you can use the Pension Tracing Service. This free government service will ask questions to help track down any missing pensions.

What next?

Once you have the details you need, you can contact the pension provider and make sure all your details are up to date. They will need to confirm your identity, so make sure you have your NI number to hand and any previous names or addresses that might be associated with your pension.

As a side note – is always important to make sure the details they hold on file for you are up to date. Such as your current residential address and your nominated beneficiaries.

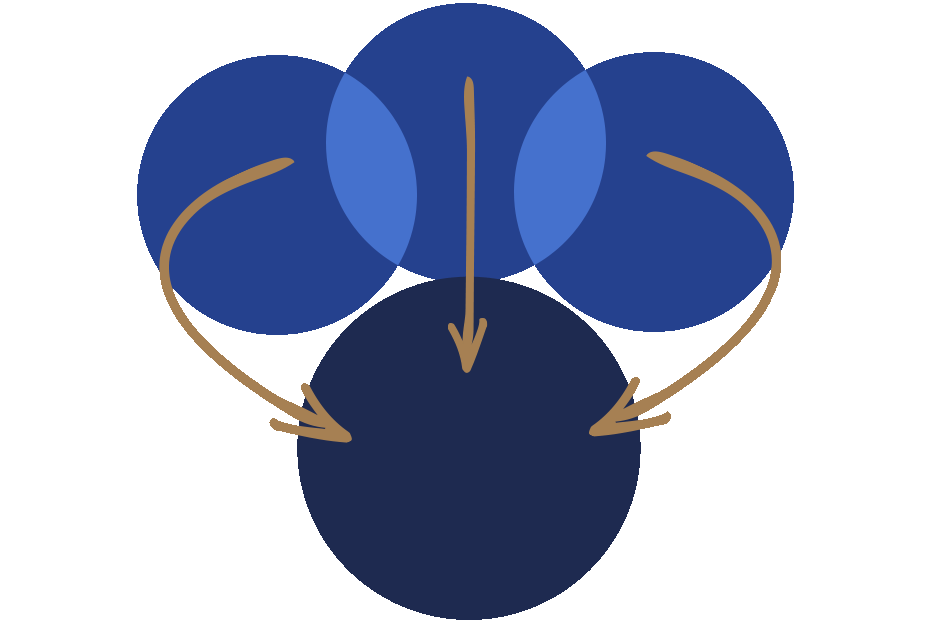

When you know exactly what pensions you have, and where they are, you might consider consolidating them all, for ease of management. It is important to understand the rules surrounding each pension as these can differ. Also, consider the investment strategy adopted and whether it matches your attitude to investment risk and time horizon. Pay close attention to the fees attributed to your pension and the mechanisms they offer for accessing your pension in retirement. Such as drawdown, annuity purchase or whether your scheme has any guaranteed elements, as these can be valuable.

Ready to consolidate your pensions?

Before you decide to move all your pensions into one pot, you’ll need to check a few things. Check your current pension benefits and ensure that your new benefits are as good, ideally better than the ones you’ll be giving up. Make sure you are aware of any transfer charges and new account set-up and ongoing costs.

It is also important to check your new provider is stable. Ensure any personal pensions are appropriately regulated by the Financial Conduct Authority (FCA).

If you transfer the funds as cash, your money will be temporarily out of the market. If you transfer as stock, you retain your investment, but you can’t buy or sell until the application is complete.

If you need help with pension consolidation or would like to find out more, get in touch.

It is always a good idea to talk to an expert before making any financial decisions.

Let’s start the conversation

Online enquiry form

Related posts

Published On: September 25, 2025|2.3 min read|

Published On: September 25, 2025|2.3 min read|Longevity and Wealth – Planning to Fund 100 Years of Life

Thanks to advances in medicine, better living standards, and lifestyle awareness, many of today’s expats could easily live well into their 90s—or even past 100. While that’s good news for health and family, it presents a major financial challenge: How do you ensure your wealth lasts as long as you do?

Read more

Published On: September 3, 2025|2.2 min read|

Published On: September 3, 2025|2.2 min read|UK Budget 2025 Predictions – What Expats Should Be Watching

The Budget will take place on Wednesday 26 November, the chancellor has announced. With the UK shifting from a domicile-based to a residence-based tax system, the 2025 Budget is likely to bring further adjustments that expats need to watch closely.

Read more

Published On: May 20, 2025|3.4 min read|

Published On: May 20, 2025|3.4 min read|Accessing Your Pension at 55? That’s About to Change

The UK government is set to raise the Normal Minimum Pension Age (NMPA) from 55 to 57, effective 6 April 2028. This change will impact when individuals can begin drawing from their private pensions, including personal and workplace defined contribution schemes.

Read more