Many individuals, even some financial advisors, possess an uninformed or incorrect understanding of what “risk” really entails in the context of investing.

We often misinterpret risk and it can have severe implications.

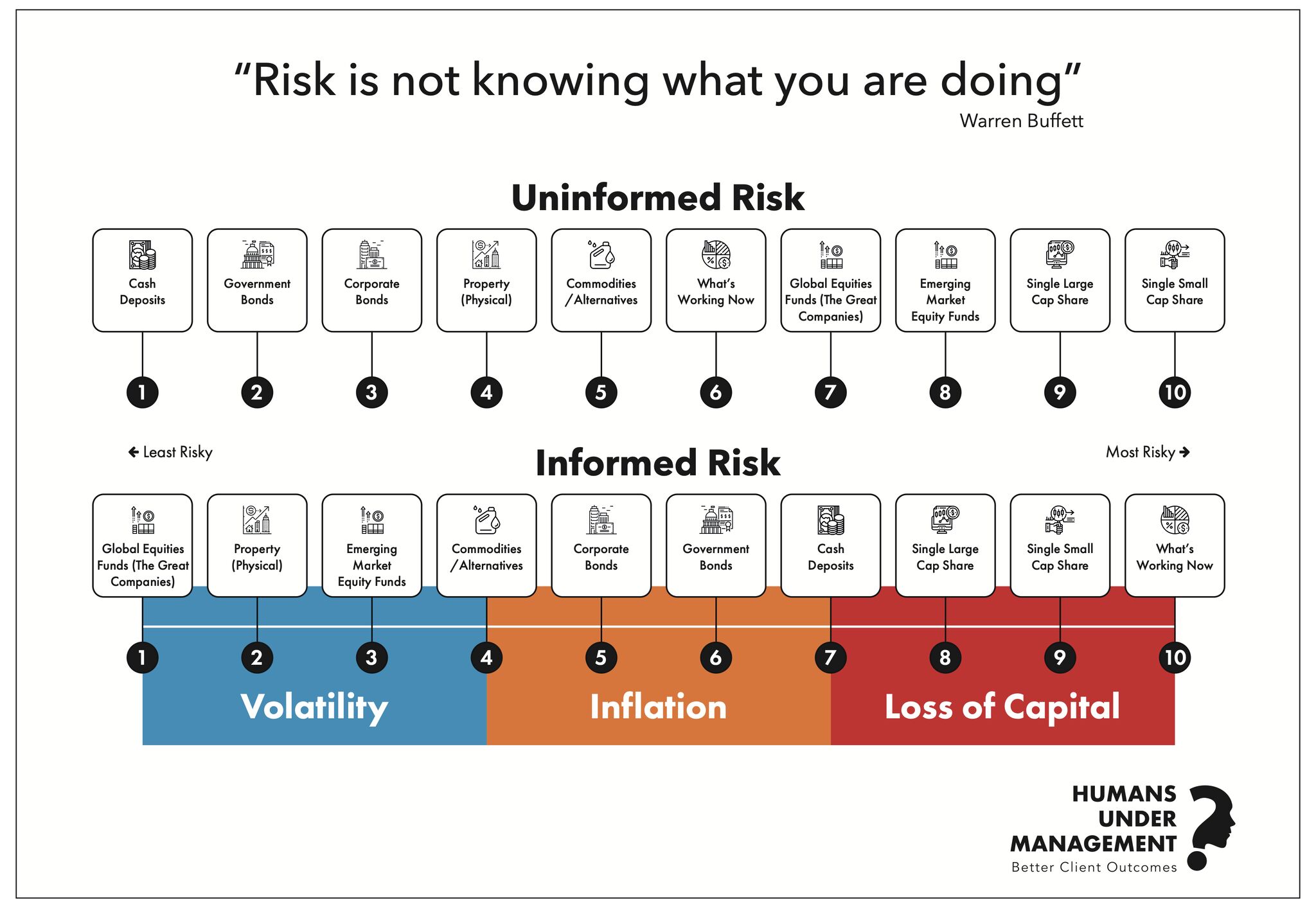

The image below is a scale of risk – better known as the informed risk scale. It seeks to, distinguish between informed and uninformed perceptions of risk.

Let’s start with volatility

Many individuals confuse market volatility with risk. Volatility is the short-term fluctuation in the value of investments, while risk is more accurately related to the likelihood of permanent loss or the failure to meet financial goals. This misunderstanding can lead investors to make poor investment decisions during market downturns, such as selling off assets at a loss out of fear. Or take a person who perceives market volatility as an unbearable risk. They might insist on overly conservative investments that do not keep pace with inflation, thus endangering their financial future.

Traditional financial advice often fails to consider the psychological elements that influence investing. Many financial missteps are due to psychological biases rather than informational shortcomings. For instance, the ‘recency bias’ leads people to expect that recent occurrences (like a market downturn) will continue to happen, causing irrational fear or optimism.

Then there’s the risk of not achieving financial goals

Individuals often overlook this fundamental risk. The real risk is not short-term fluctuations in the market but rather the possibility that a financial strategy may not align with an individual’s or family’s long-term goals. It’s imperative to focus on strategic planning over tactical moves influenced by market conditions.

Then there are behavioural biases

Behavioural biases significantly contribute to misinterpretations of risk. Biases such as loss aversion, where we can be more sensitive to losses than to gains, can skew the perception of risk and lead to bad decision-making. It’s important to develop a more sophisticated understanding of what risks are relevant to your unique situation and how to manage them effectively.

Use the Informed Risk Scale as a tool to help rectify these misunderstandings, It’s a conceptual framework aimed at helping investors to understand and navigate the complexities of risk in investing.

Do you recognise any behavioural biases in your own investing decisions?

Benefit from comprehensive, integrated, and objective advice.

Let’s discuss your specific needs and how I can help you meet your objectives

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: July 10, 2024|3.2 min read|

The Merits of Accessing Your Pension Commencement Lump Sum in Stages

As you approach retirement, one of the significant decisions you'll face is how to access your pension commencement lump sum (PCLS). While it might be tempting to take the entire amount in one go, there are several benefits to accessing your PCLS in stages.

Read more

- Published On: July 8, 2024|3.2 min read|

The Problem with Structured Notes for Retail Investors: Opaqueness, Provider Risk, and Hidden Commissions

Structured notes are financial instruments that can seem attractive due to their potential for high returns and tailored investment strategies. However, they come with significant risks and drawbacks, especially for retail investors.

Read more

- Published On: July 3, 2024|2.4 min read|

Understanding Inheritance Tax for UK Domicles: What You Need to Know

Inheritance tax (IHT) is a topic that often causes concern, but understanding it can help you plan more effectively for the future. Here’s a concise overview of what you need to know about inheritance tax, how it works, and ways to manage it.

Read more