ESG Investing (Sustainable Investing) is growing exponentially as more investors and issuers utilise ESG and climate data and tools to support investment decision-making.

ESG investing is the consideration of environmental, social and governance (ESG) factors, alongside financial aspects, in the investment decision-making process.

Environmental factors look at the conservation of the natural world. Social factors examine how a company treats people inside and outside the company and governance factors consider how a company is run.

The number of investors looking for sustainable opportunities both on the equity and fixed income side is on the rise. Providers and investors alike are scrambling to jump aboard the sustainable bandwagon.

This is down to several factors:

Regulators and governments are expanding their focus on incorporating sustainability into investment making and decision making

There is growing recognition that ESG research can potentially identify investment risks and generate excess returns

Decision makers are asking more of companies and are seeking more sustainable solutions

An ESG strategy means investing in companies that score highly on environmental and societal responsibility scales as determined by third parties, independent companies and research groups.

Different labels like sustainable investing, socially responsible investing, ethical investing and impact investing all form part of ESG investing;

ESG factors cover an extensive range of issues – from avoiding investing in tobacco companies to financing clean water initiatives. Companies that produce clean energy solutions or provide access to essential resources may be obvious candidates because of what products or services they offer. But just as important as what products or services a company offers is how a company conducts business, in essence, the impact of its day-to-day operations.

More than half of the S&P 500 incorporated ESG metrics into incentive plans at the start of 2021, ESG has the attention of a broad group of stakeholders. Accordingly, organizations’ approach to ESG must address the needs of a wide range of interests.

By considering ESG factors, investors get a more holistic view of the companies they back, which can help mitigate risk and identify opportunities.

ESG investing uses particular criteria to grade investments to clarify exactly what sustainability should look like. But many ESG practices have no standard definitions or objective measurements, which can result in different ESG ratings for the same company. For example, two reputable ESG rating firms ranked Tesla on opposite ends of the environmental spectrum. This is not an isolated example, as a recent study by professors at MIT found widespread divergence in ESG ratings. Many ESG rating services use dozens of variables with subjective measurement criteria and do not provide granular reporting on specific variables.

In addition, the context for ESG requirements is critical. Many people have specific ethical desires when it comes to investing, but to satisfy just those requirements, they would end up with a very narrow range of equities, which are not necessarily good long-term from growth of diversification point of view.

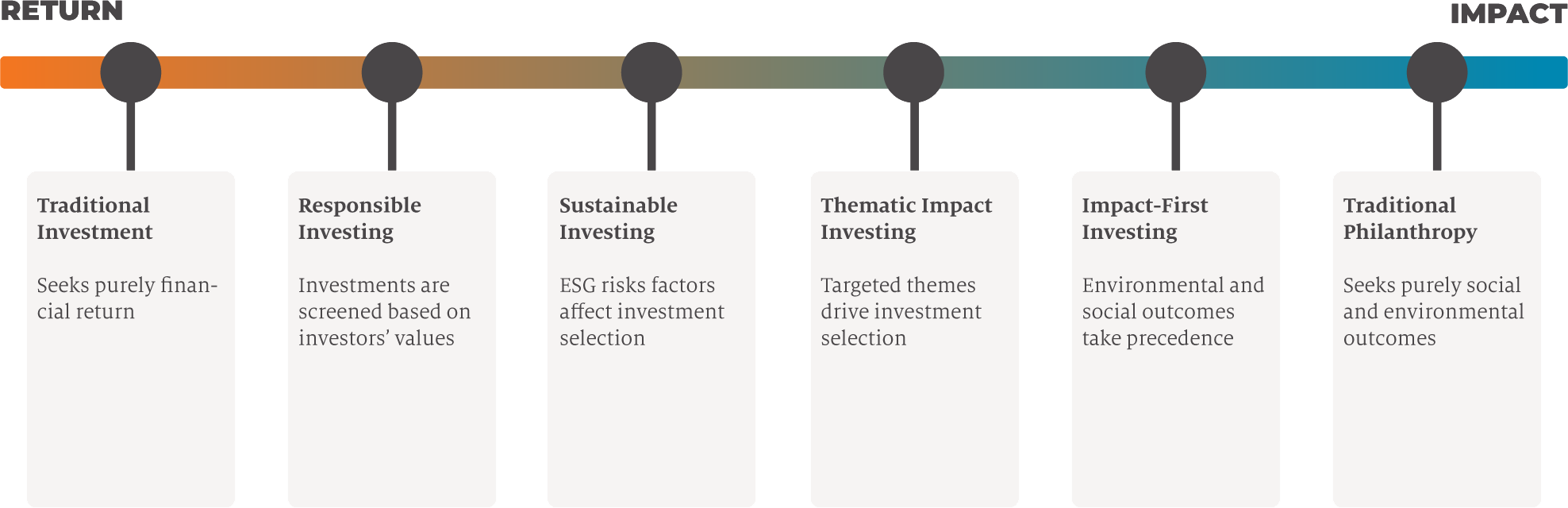

Investments somewhere to the right side of the below scale are generally where returns matter less than environmental impact.

Conversely, the left-hand side of the scale is also a mismatch with the basic elements of a robust investment philosophy. That is – diversification, global exposure, long-term, market-based, and low cost.

ESG investing as a whole is still in its infancy and therefore, investors should tread with some caution, as there are many portfolios which either offer a very light “screening” of companies, so sit too far to the left of the spectrum, or too far to the right, which makes them more impact or philanthropic – neither of which are in the best interests of the investor.

Due to the multitude of ESG practices that can be analyzed, a strategy should focus on well-defined goals and create a standard for measuring outcomes. The strategy should enable investors to customize regional and asset class exposure and build global allocations while consistently applying clearly defined sustainability criteria.

If you need help with ESG investing or would like to find out more, get in touch.

It is always a good idea to talk to an expert before making any financial decisions.

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: July 8, 2024|3.2 min read|

The Problem with Structured Notes for Retail Investors: Opaqueness, Provider Risk, and Hidden Commissions

Structured notes are financial instruments that can seem attractive due to their potential for high returns and tailored investment strategies. However, they come with significant risks and drawbacks, especially for retail investors.

Read more