The world seems to be watching with concern.The uncertainty is being felt around the globe, and it is unsettling on a human level as well as from the perspective of how markets respond.

Over the last few days, the markets have fallen as the spread of the virus has continued and thus the view over it’s potential impact on supply chains and possible wider global economic health has become increasingly negative.During periods of high market volatility we need to remind ourselves that the long-term trajectory for market assets is higher. And so, even if we should see the markets continue to fall over the coming days and weeks, once the threat of the virus has lifted, and life starts to get back to normal again, these corporations will recover and thus the value of these assets will start rising again – as they always have.

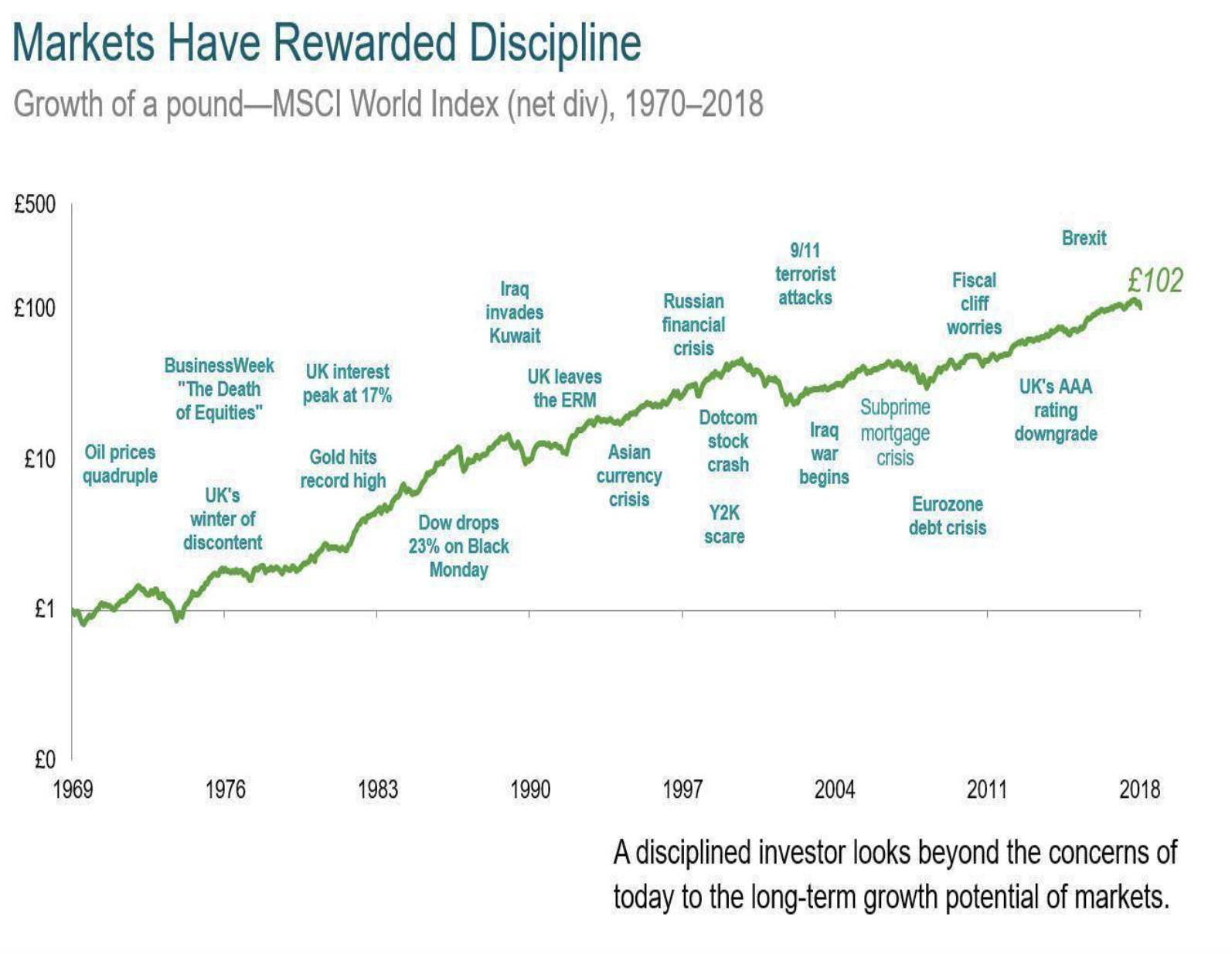

I think the below diagram is quite useful in understanding discrete market corrections against a wider market picture.

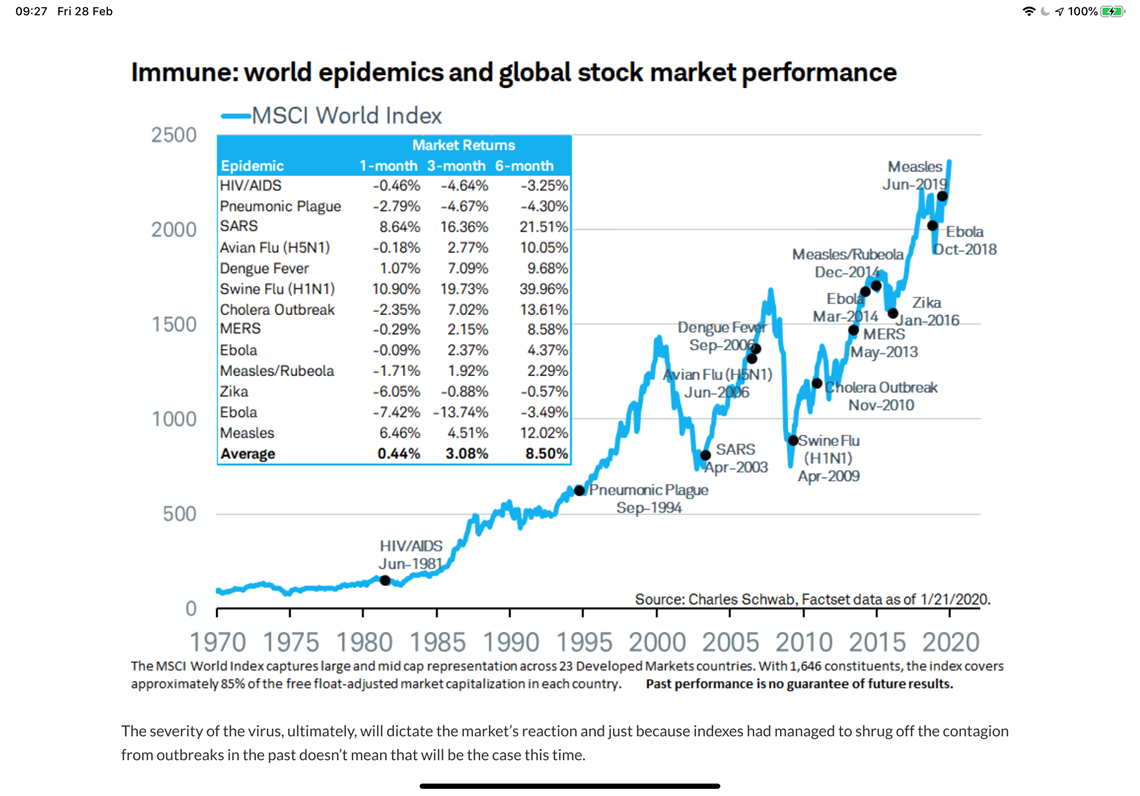

And lets take a look at the global stock market performance following previous world epidemics.Notably there was a big drop in 2003 when SARS struck. But just look how the markets keep bouncing back.

it is a fundamental principle that markets are designed to handle uncertainty, processing information in real-time as it becomes available. We see this happening when markets decline sharply, as they have recently, as well as when they rise. Such declines can be distressing to any investor, but they are also a demonstration that the market is functioning as we would expect.

Market declines can occur when investors are forced to reassess expectations for the future. The expansion of the outbreak is causing worry among governments, companies, and individuals about the impact on the global economy.

Apple announced earlier this month that it expected revenue to take a hit from problems making and selling products in China. Australia’s prime minister has said the virus will likely become a global pandemic, and other officials there warned of a serious blow to the country’s economy. Airlines are preparing for the toll it will take on travel. And these are just a few examples of how the impact of the coronavirus is being assessed.

The market is clearly responding to new information as it becomes known, but the market is pricing in unknowns, too. As risk increases during a time of heightened uncertainty, so do the returns investors demand for bearing that risk, which pushes prices lower.

We can’t tell you when things will turn or by how much, but the expectation is that bearing today’s risk will be compensated with positive expected returns. That’s been a lesson of past health crises, such as the Ebola and swine-flu outbreaks earlier this century, and of market disruptions, such as the global financial crisis of 2008–2009 as demonstrated above.

Additionally, history has shown no reliable way to identify a market peak or bottom. These beliefs argue against making market moves based on fear or speculation, even as difficult and traumatic events transpire. The key is to help clients develop a long-term plan they can stick with in a variety of conditions. That is why it’s so important to consider a wide range of possible outcomes, both good and bad, when helping clients establish an asset allocation and plan. These preparations include the possibility, even the inevitability, of a downturn.

Amid the anxiety that accompanies developments surrounding the coronavirus, decades of financial science and long-term investing principles remain a strong guide. It’s very difficult to ignore all of the noise, but history dictates that markets will start rising again – as they always have.

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: July 8, 2024|3.2 min read|

The Problem with Structured Notes for Retail Investors: Opaqueness, Provider Risk, and Hidden Commissions

Structured notes are financial instruments that can seem attractive due to their potential for high returns and tailored investment strategies. However, they come with significant risks and drawbacks, especially for retail investors.

Read more