With the blink of an eye, we’re well into into the final quarter of the year.

We all hope the miserable stock market performance of last December will not be repeated, but there are plenty of challenges all the same.

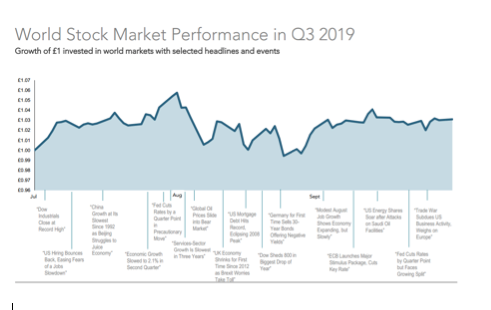

The political environment leaves much to be desired and on the economic front growth is slowing.

The current expansion is one of the longest on record and the world’s two largest economies are locked in a trade war with no obvious endpoint. However, despite all this, there’s welcome news for investors.

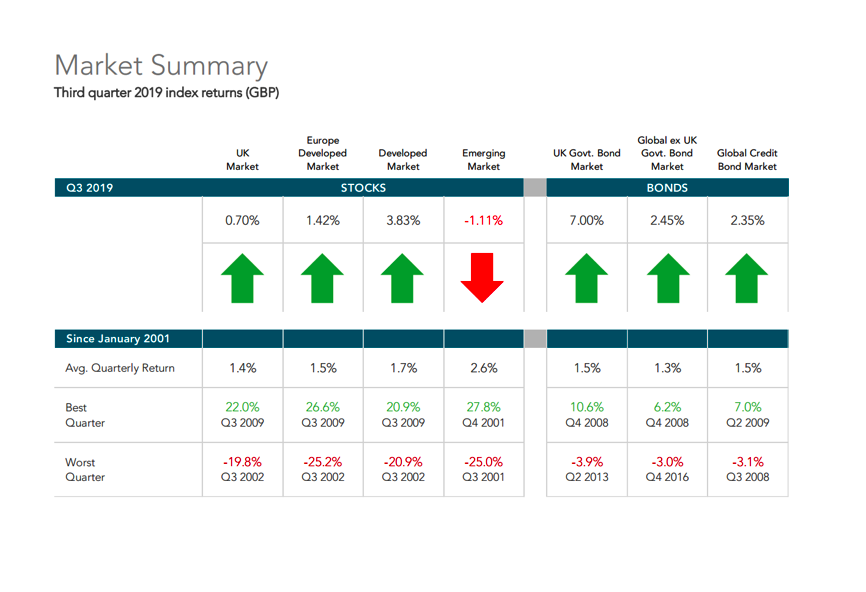

Q3 returns were positive across 6 out of 7 sectors.

Let’s take a closer look…

Of course, the short-term movements we see in Q3 are only a small part of the bigger picture.

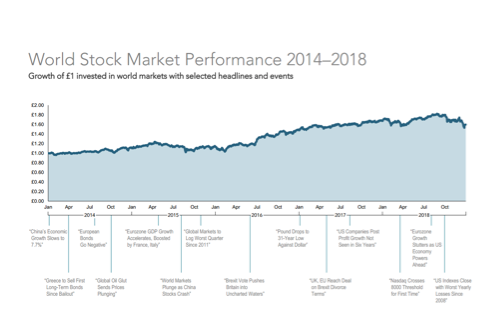

As long-term investors, staying patient and disciplined is rewarding as we see in the long-term performance of the same index over 2014-2018.

I once read a piece that compared the world economy to a 400,000 tonne supertanker chugging across the Indian ocean. It’s big and robust, speeds up, slows down and gradually changes direction. But, it rarely does anything very quickly.

It’s a clever analogy as the world economy is pretty stable most of the time with the exception of major global financial crises like the ones seen in 1929 and 2008.

Yet, even then, the economy recovered and got back on track.

Investors who stayed put were handsomely rewarded for their discipline, patience and resilience.

That being said, I remain confident that we will end 2019 on a positive note.

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: July 8, 2024|3.2 min read|

The Problem with Structured Notes for Retail Investors: Opaqueness, Provider Risk, and Hidden Commissions

Structured notes are financial instruments that can seem attractive due to their potential for high returns and tailored investment strategies. However, they come with significant risks and drawbacks, especially for retail investors.

Read more