Are you falling prey to these common investment blunders or are you wisely navigating the market’s unpredictable tides?

World events impact our finances, stirring emotions that can damage financial health. Emotions are contagious and can obstruct wise investment decisions. Two common snares often challenge even astute investors.

Forecasting Economies

Economists help us understand economic indicators’ current trajectory, yet reliance on these for outright forecasts can lead long-term investors astray. Accurate forecasts about interdependent variables are mostly doomed to fail.

Post-event forecasts usually have poor track records. Being informed about the economy is good, but focusing on short-term changes isn’t beneficial for long-term investors.

Timing Investment Markets

The confidence that investment market cycles can be consistently timed is the investor’s biggest pitfall. Stock markets, being forward-looking entities and influenced by millions of investors, are notoriously unpredictable.

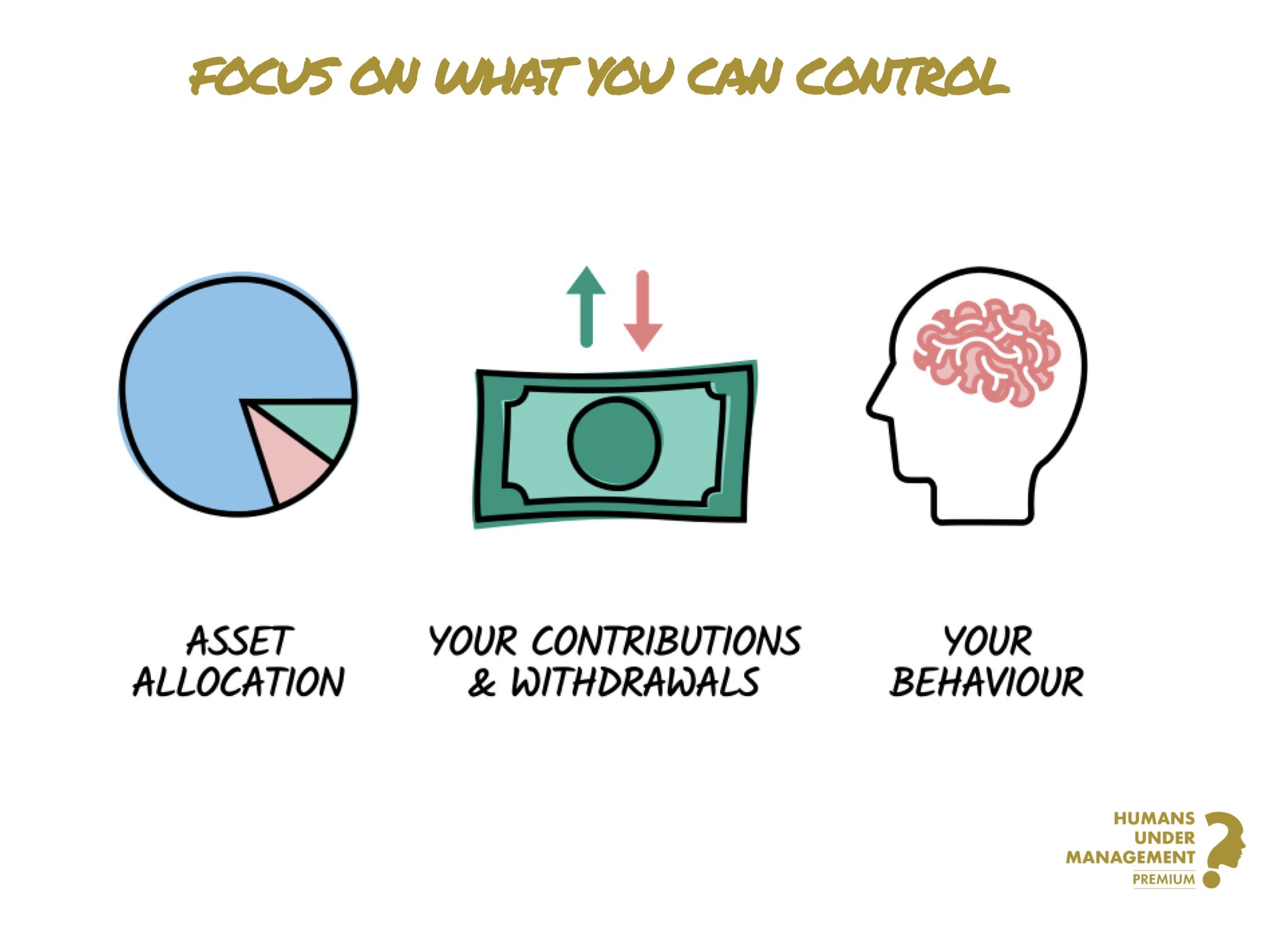

Guessing when markets will fall or rise has cost many investors dearly. Instead, long-term investors should focus on the right asset mix, controlling expenses, contributing significantly, and acknowledging that behaviour impacts financial success.

A Better Approach

Uncertainty about the immediate future is par for the course for investors. But, assuming that recent trends will continue indefinitely is unrealistic. It’s important to remember that short-term volatility is likely. Avoiding the temptation to time these cycles is the intelligent investor’s most important skill.

Benefit from comprehensive, integrated, and objective advice.

Let’s discuss your specific needs and how I can help you meet your objectives

Find out how we can help you

If you would like to understand more about this topic get in touch

Related posts

- Published On: July 10, 2024|3.2 min read|

The Merits of Accessing Your Pension Commencement Lump Sum in Stages

As you approach retirement, one of the significant decisions you'll face is how to access your pension commencement lump sum (PCLS). While it might be tempting to take the entire amount in one go, there are several benefits to accessing your PCLS in stages.

Read more

- Published On: July 8, 2024|3.2 min read|

The Problem with Structured Notes for Retail Investors: Opaqueness, Provider Risk, and Hidden Commissions

Structured notes are financial instruments that can seem attractive due to their potential for high returns and tailored investment strategies. However, they come with significant risks and drawbacks, especially for retail investors.

Read more

- Published On: July 3, 2024|2.4 min read|

Understanding Inheritance Tax for UK Domicles: What You Need to Know

Inheritance tax (IHT) is a topic that often causes concern, but understanding it can help you plan more effectively for the future. Here’s a concise overview of what you need to know about inheritance tax, how it works, and ways to manage it.

Read more