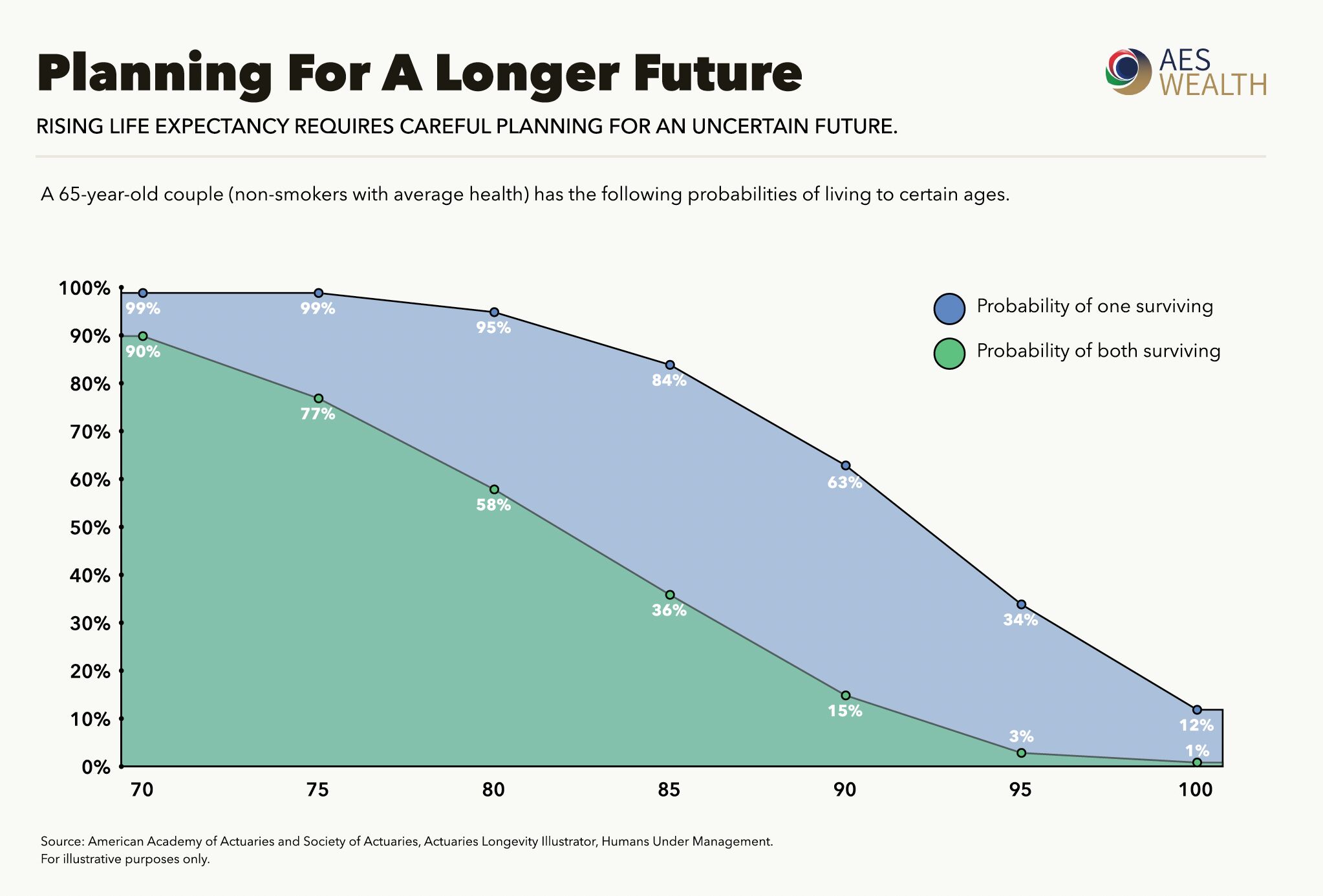

As life expectancy continues to rise, careful planning for an uncertain future becomes essential. Take a look at this chart highlighting the probabilities of a 65-year-old couple living to certain ages. It underscores the critical need for lifetime cash flow planning.

In today’s fast-paced world, ensuring financial stability throughout your life is more crucial than ever. Lifetime cash flow planning isn’t just about managing your money; it’s about creating a roadmap that aligns with your long-term goals and aspirations.

Why is it important?

- Financial Security: Planning helps you understand and manage your income and expenses, ensuring you can maintain your lifestyle through various life stages.

- Increasing Longevity: With higher chances of living longer, it’s vital to ensure your financial resources last throughout your life. You need to have a good understanding of how long your money will last, to ensure that your money outlives you, not the other way around.

- Goal Achievement: Whether it’s buying a home, funding education, or planning retirement, a well-structured plan helps you reach your milestones.

- Peace of Mind: Knowing you have a financial plan in place provides confidence and reduces stress, allowing you to focus on what truly matters.

So, where do you stand? Do you have an ironclad plan in place? Lifetime cash flow modeling is a crucial step in ensuring your financial stability and achieving your long-term goals. Don’t leave your future to chance.

Benefit from comprehensive, integrated, and objective advice.

Let’s discuss your specific needs and how I can help you meet your objectives

Let’s start the conversation

Online enquiry form

Related posts

Published On: November 14, 2025|5 min read|

Published On: November 14, 2025|5 min read|The Hidden Risks of Going It Alone with Your Investments

Many people start trading their life savings after reading a few investment books or watching online tutorials. Here’s why that can be dangerous — and when it’s perfectly fine to trade with spare money instead.

Read more

Published On: November 10, 2025|5.3 min read|

Published On: November 10, 2025|5.3 min read|How to Choose the Right Financial Adviser Before Moving Abroad (UK Residents Planning to Relocate)

If you’re planning to relocate abroad, find out how a UK-qualified financial adviser can help you prepare. Learn about tax residency, Double Taxation Agreements (DTAs), the Statutory Residence Test (SRT), offshore accounts, and how to structure assets before you leave.

Read more

Published On: November 7, 2025|6 min read|

Published On: November 7, 2025|6 min read|Should You Sell or Keep Your UK Property When Moving Abroad?

For many people leaving the UK, one of the biggest decisions isn’t what to pack, it’s what to do with the family home or investment property. Should you sell before you leave, or keep it and rent it out while you live abroad?

Read more